-

Financial reporting and accounting advisory services

You trust your external auditor to deliver not only a high-quality, independent audit of your financial statements but to provide a range of support, including assessing material risks, evaluating internal controls and raising awareness around new and amended accounting standards.

-

Accounting Standards for Private Enterprises

Get the clear financial picture you need with the accounting standards team at Grant Thornton LLP. Our experts have extensive experience with private enterprises of all sizes in all industries, an in-depth knowledge of today’s accounting standards, and are directly involved in the standard-setting process.

-

International Financial Reporting Standards

Whether you are already using IFRS or considering a transition to this global framework, Grant Thornton LLP’s accounting standards team is here to help.

-

Accounting Standards for Not-for-Profit Organizations

From small, community organizations to large, national charities, you can count on Grant Thornton LLP’s accounting standards team for in-depth knowledge and trusted advice.

-

Public Sector Accounting Standards

Working for a public-sector organization comes with a unique set of requirements for accounting and financial reporting. Grant Thornton LLP’s accounting standards team has the practical, public-sector experience and in-depth knowledge you need.

-

Tax planning and compliance

Whether you are a private or public organization, your goal is to manage the critical aspects of tax compliance, and achieve the most effective results. At Grant Thornton, we focus on delivering relevant advice, and providing an integrated planning approach to help you fulfill compliance obligations.

-

Research and development and government incentives

Are you developing innovative processes or products, undertaking experimentation or solving technological problems? If so, you may qualify to claim SR&ED tax credits. This Canadian federal government initiative is designed to encourage and support innovation in Canada. Our R&D professionals are a highly-trained, diverse team of practitioners that are engineers, scientists and specialized accountants.

-

Indirect tax

Keeping track of changes and developments in GST/HST, Quebec sales tax and other provincial sales taxes across Canada, can be a full-time job. The consequences for failing to adequately manage your organization’s sales tax obligations can be significant - from assessments, to forgone recoveries and cash flow implications, to customer or reputational risk.

-

US corporate tax

The United States has a very complex and regulated tax environment, that may undergo significant changes. Cross-border tax issues could become even more challenging for Canadian businesses looking for growth and prosperity in the biggest economy in the world.

-

Cross-border personal tax

In an increasingly flexible world, moving across the border may be more viable for Canadians and Americans; however, relocating may also have complex tax implications.

-

International tax

While there is great opportunity for businesses looking to expand globally, organizations are under increasing tax scrutiny. Regardless of your company’s size and level of international involvement—whether you’re working abroad, investing, buying and selling, borrowing or manufacturing—doing business beyond Canada’s borders comes with its fair share of tax risks.

-

Transfer pricing

Transfer pricing is a complex area of corporate taxation that is concerned with the intra-group pricing of goods, services, intangibles, and financial instruments. Transfer pricing has become a critical governance issue for companies, tax authorities and policy makers, and represents a principal risk area for multinationals.

-

Succession & estate planning

Like many private business owners today, you’ve spent your career building and running your business successfully. Now you’re faced with deciding on a successor—a successor who may or may not want your direct involvement and share your vision.

-

Tax Reporting & Advisory

The financial and tax reporting obligations of public markets and global tax authorities take significant resources and investment to manage. This requires calculating global tax provision estimates under US GAAP, IFRS, and other frameworks, and reconciling this reporting with tax compliance obligations.

-

Transactions

Our transactions group takes a client-centric, integrated approach, focused on helping you make and implement the best financial strategies. We offer meaningful, actionable and holistic advice to allow you to create value, manage risks and seize opportunities. It’s what we do best: help great organizations like yours grow and thrive.

-

Restructuring

We bring a wide range of services to both individuals and businesses – including shareholders, executives, directors, lenders, creditors and other advisors who are dealing with a corporation experiencing financial challenges.

-

Forensics

Market-driven expertise in investigation, dispute resolution and digital forensics

-

Consulting

Running a business is challenging and you need advice you can rely on at anytime you need it. Our team dives deep into your issues, looking holistically at your organization to understand your people, processes, and systems needs at the root of your pain points. The intersection of these three things is critical to develop the solutions you need today.

-

Creditor updates

Updates for creditors, limited partners, investors and shareholders.

-

Governance, risk and compliance

Effective, risk management—including governance and regulatory compliance—can lead to tangible, long-term business improvements. And be a source of significant competitive advantage.

-

Internal audit

Organizations thrive when they are constantly innovating, improving or creating new services and products and envisioning new markets and growth opportunities.

-

Certification – SOX

The corporate governance landscape is challenging at the best of times for public companies and their subsidiaries in Canada, the United States and around the world.

-

Third party assurance

Naturally, clients and stakeholders want reassurance that there are appropriate controls and safeguards over the data and processes being used to service their business. It’s critical.

-

ASPE Sec. 3041 Agriculture Understanding and applying the new ASPE Section 3041 AgricultureThe Canadian Accounting Standards Board (AcSB) has released new guidance on recognizing, measuring and disclosing biological assets and the harvested products of bio assets.

ASPE Sec. 3041 Agriculture Understanding and applying the new ASPE Section 3041 AgricultureThe Canadian Accounting Standards Board (AcSB) has released new guidance on recognizing, measuring and disclosing biological assets and the harvested products of bio assets. -

Tax alert Agricultural Clean Technology ProgramThe Agricultural Clean Technology Program will provide financial assistance to farmers and agri-businesses to help them reduce greenhouse gas (GHG) emissions.

Tax alert Agricultural Clean Technology ProgramThe Agricultural Clean Technology Program will provide financial assistance to farmers and agri-businesses to help them reduce greenhouse gas (GHG) emissions. -

Tax alert ACT Program – Research and Innovation Stream explainedThe ACT Research and Innovation Stream provides financial support to organizations engaged in pre-market innovation.

Tax alert ACT Program – Research and Innovation Stream explainedThe ACT Research and Innovation Stream provides financial support to organizations engaged in pre-market innovation. -

Tax alert ACT Program – Adoption Stream explainedThe ACT Adoption Stream provides non-repayable funding to help farmers and agri-business with the purchase and installation of clean technologies.

Tax alert ACT Program – Adoption Stream explainedThe ACT Adoption Stream provides non-repayable funding to help farmers and agri-business with the purchase and installation of clean technologies.

-

Builders And Developers

Every real estate project starts with a vision. We help builders and developers solidify that vision, transform it into reality, and create value.

-

Rental Property Owners And Occupiers

In today’s economic climate, it’s more important than ever to have a strong advisory partner on your side.

-

Real Estate Service Providers

Your company plays a key role in the success of landlords, investors and owners, but who is doing the same for you?

-

Mining

There’s no business quite like mining. It’s volatile, risky and complex – but the potential pay-off is huge. You’re not afraid of a challenge: the key is finding the right balance between risk and reward. Whether you’re a junior prospector, a senior producer, or somewhere in between, we’ll work with you to explore, discover and extract value at every stage of the mining process.

-

Oil & gas

The oil and gas industry is facing many complex challenges, beyond the price of oil. These include environmental issues, access to markets, growing competition from alternative energy sources and international markets, and a rapidly changing regulatory landscape, to name but a few.

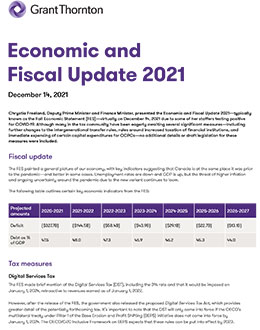

Fiscal update

The FES painted a general picture of our economy, with key indicators suggesting that Canada is at the same place it was prior to the pandemic—and better in some cases. Unemployment rates are down and GDP is up, but the threat of higher inflation and ongoing uncertainty around the pandemic due to the new variant continues to loom.

The following table outlines certain key economic indicators from the FES:

| Projected amounts | 2020-2021 | 2021-2022 | 2022-2023 | 2023-2024 | 2024-2025 | 2025-2026 | 2026-2027 |

| Deficit | ($327.7B) | ($144.5B) | ($58.4B) | ($43.9B) | ($29.1B) | ($22.7B) | ($13.1B) |

| Debt as % of GDP | 47.5 | 48.0 | 47.3 | 46.9 | 46.2 | 45.3 | 44.0 |

Tax measures

Digital Services Tax

The FES made brief mention of the Digital Services Tax (DST), including the 3% rate and that it would be imposed on January 1, 2024, retroactive to revenues earned as of January 1, 2022.

However, after the release of the FES, the government also released the proposed Digital Services Tax Act, which provides greater detail of the potentially forthcoming tax. It’s important to note that the DST will only come into force if the OECD’s multilateral treaty under Pillar 1 of the Base Erosion and Profit Shifting (BEPS) initiative does not come into force by January 1, 2024. The OECD/G20 Inclusive Framework on BEPS expects that these rules can be put into effect by 2023.

Key characteristics of the DST

- 3% tax rate on revenues from certain digital services involving engagement, data and content contribution of Canadians as well as the licensing and sale of user data.

- Applicable to large domestic and foreign businesses that meet both of the following revenue thresholds:

- Total Revenue threshold: Consolidated revenue from all sources of €750,000,000 or greater in a fiscal year, and

- In-scope Revenue threshold: Consolidated revenue from in-scope Canadian revenues of greater than C$20,000,000 in the calendar year.

- DST applies to in-scope revenue in excess of a C$20,000,000 threshold, shared amongst all members of the consolidated group, with certain pro-rata adjustments required when there are changes to the group.

- In-scope revenue is as follows:

- Online marketplace services revenue: commissions and revenues from providing an online marketplace, as well as premium-service fee revenue. Fees for storage and shipping and financial service providers would be excluded.

- Online advertising services revenue: fees earned for targeted online advertising, with an anti-cascading rule to prevent taxing the same revenue when paid from one entity in online advertising to another.

- Social media services revenue: revenue from social media platforms including premium services and facilitating user interaction or user-generated content. Platforms whose sole purpose is to private communication services such as video/voice calls, emails and instant messaging are excluded.

- User data revenue: revenue from the sale or licensing of user data.

Sourcing and location

- DST applies only to in-scope revenue sourced to Canada. The sourcing of revenue to Canada can be based on the user’s location or, if revenue cannot be traced to specific users, on a formulaic approach. Sourcing varies, depending on the type of in-scope revenue.

- Online marketplace services revenue is based on one of three methods:

1. If earned from a supply of a service delivered in physical form (e.g., transportation or accommodations) and the service is performed in Canada, sourced entirely to Canada.

2. If earned from facilitating transaction between users, sourcing depends on location of users. If both in Canada, revenue is sourced entirely to Canada. If only one is in Canada, 50% is sourced to Canada.

3. If online marketplace revenue cannot be traced to a specific transaction, a formulaic approach applies, based on the percentage of marketplace participants located in Canada. - Online advertising services revenue is based on one of two methods:

1. If revenue can be traced to the display of an advertisement to a specific user located in Canada, it’s traced entirely to Canada.

2. If revenue cannot be traced to specific users, a formulaic approach applies, based on the percentage of users that the advertisement was displayed to located in Canada. - Social media services revenue: a formulaic approach applies, based on the percentage of users located in Canada.

- User data revenue is based on one of two methods:

1. If revenue can be traced to user data of a single user located in Canada, it’s sourced entirely to Canada.

2. If revenue is from a data set of multiple users, revenue is sourced based on the percentage of those users located in Canada.

- Online marketplace services revenue is based on one of three methods:

- The location of a user is determined based on the user data that the taxpayer has available. This can include the billing or shipping address or phone number that was most recently provided; or GPS or IP address data, where applicable.

- Since some in-scope revenue sources can be based on the location of a user, the user’s ordinary location is applicable. For example, a user who is in Canada only on vacation would not be considered to be located in Canada for most cases of in-scope revenue. However, if a targeted advertisement is made or user data is sold based on real-time location, the user’s location at the time the advertisement was sold or data is collected would be relevant.

Filing, Payment and Administrative requirements

- Taxpayers that meet two (slightly different) thresholds are required to register for the DST by January 31 of the year following when the thresholds are met:

- Consolidated revenue from all sources of €750,000,000 or greater in a fiscal year, and

- Consolidated revenue from in-scope Canadian revenues of greater than C$10,000,000 (not $20 million, as above) in the calendar year

- A DST return will be required to be filed for taxpayers that meet the threshold. The due date for the return and the tax owing will be June 30 of the calendar year following the calendar year for which the return is required to be filed. Note: the deadline is not six months after year-end, which is the filing deadline for corporate tax returns in Canada.

- Any one entity in a consolidated group can be designated to fulfill the above-noted filing and payment obligations of the group; however, all members are jointly and severally liable for the tax.

- The DST would potentially be deductible in computing taxable income if incurred for the purpose of earning income, as per general Canadian tax principles. However, no credit is available against income taxes.

Small Businesses Air Quality Improvement Tax Credit

The Small Businesses Air Quality Improvement Tax Credit—arguably the most significant new tax measure in the FES—is meant to encourage small businesses to improve air quality at their place of business.

Its key characteristics are:

- Eligible entities: sole proprietors and Canadian-controlled private corporations (CCPC) with taxable capital less than $15 million in the previous year. Members of partnerships can claim the credit, provided they are either an individual or a qualifying CCPC.

- 25% refundable tax credit on qualifying expenditures (QE)

- Maximum QE of $10,000 per location and $50,000 across all qualifying locations.

- QE must be incurred between September 1, 2021 and December 31, 2022.

- QEs incurred before January 1, 2022 are claimed in the first tax year ending after January 1, 2022.

- QEs incurred after January 1, 2022 are claimed in the tax year the expense is incurred.

- QEs include purchases and upgrades of HVAC and HEPA (air filter) systems that meet certain minimum air filtration rate requirements (minimum efficiency reporting value, or MERV, of 8).

- Certain exclusions apply to agreements entered into before September 1, 2021—repairs and maintenance, financing costs, payments to non-arm’s length parties or for employee wages and for amounts that would be returned to the eligible entity.

- Any government assistance received that reduces the amount of the expense, which would reduce the amount of the QE.

Refundable tax credit on fuel charges

Under the carbon pollution pricing system (i.e. carbon tax), the federal government returns the proceeds to the provincial governments for provinces that have adopted the federal system. In those provinces where the federal requirements are not met, i.e. Ontario, Alberta, Manitoba and Saskatchewan, known as the “back-stop jurisdictions”, the proceeds from the carbon tax are, for the most part, returned to individuals. In Budget 2021, the government announced it would also return the proceeds from the carbon tax directly to farmers. In the FES, the government has proposed to provide this support via a refundable tax credit and has provided the following additional details.

It’s expected that the following farming businesses would be eligible to receive this refundable tax credit:

- Corporations, individuals, partnerships and trusts that are actively engaged in farming,

- Incur a total farming expenses of $25,000 or more, and

- All or a portion of the expenses are attributable to backstop jurisdictions (i.e. Ontario, Manitoba, Saskatchewan and Alberta)

The credit amount is calculated by multiplying the eligible farming expenses with the payment rate specified by the Minister of Finance. The payment rate per $1,000 in eligible farming expenses for 2021 is $1.47 (2022 - $1.73).

Eligible farming expenses are amounts deducted in calculating income from farming for tax purposes, excluding certain inventory adjustments and transactions with non-arm’s length parties. When a corporation’s taxation year is not in congruence with a calendar year, eligible farming expenses are prorated to each calendar year. Furthermore, for multi-jurisdiction businesses, eligible farming expenses are apportioned to the provinces in the same way as taxable income is allocated (i.e. based on permanent establishment rules).

Changes to Eligible Educator School Supply Tax Credit

In 2016, the Eligible Educator School Supply Tax Credit was introduced as a 15% refundable tax credit to educators who purchased certain qualifying supplies for use in their classroom or regulated childcare facility. The proposed changes in the FES increase the rate of the refundable tax credit, expand the list of qualifying expenditures and allow for the use of the supplies in any location.

The rate of the refundable tax credit will be increased to 25%, which will apply as of the 2021 taxation year.

Furthermore, certain electronic devices would also qualify for the tax credit, including:

- calculators (including graphing calculators)

- external data storage devices

- web cams, microphones and headphones

- wireless pointer devices

- electronic educational toys

- digital timers

- speakers

- video streaming devices

- multimedia projectors

- printers

- laptop, desktop and tablet computers, if none of these items are made available to the eligible educator by their employer for use outside of the classroom

Changes to Underused Housing Tax

The Underused Housing Tax was introduced in Budget 2021, although few details were provided at the time other than it was taxed at 1% of the property value and that it would apply as of January 1, 2022 to vacant or underused residential property owned by non-resident, non-Canadians.

After a consultation process, additional changes are being proposed to this upcoming tax as follows:

- the owner’s interest in a residential property is exempt if the property is the primary residence of the owner, their spouse or common-law partner, or their child is occupying that residence because they are completing their studies in Canada

- vacation/recreational properties are exempt provided:

- the property is not in a census metropolitan area or census agglomeration with more than 30,000 residents, and,

- it is personally used by the owner or their spouse or common-law partner for at least 4 weeks in the calendar year.

- An Underused Housing Tax return for 2022 will be required to be filed by April 30, 2023, along with the payment of any tax owing due by that same date.

COVID-19 measures

Although the FES did not introduce any new programs, the government had recently announced new programs that would provide wage and rent subsidies for businesses in the tourism and hospitality industries and for those that continue to experience a significant decline in revenues, as well as a reduced income support for individuals. The legislation for these new measures and other extensions is still undergoing the Parliamentary process as of the date of this article. The following table provides a summary of the government’s most significant COVID-19-related support programs that are still, or soon-to-be, available:

| Program/measure | Duration proposed | Details |

| Canada Recovery Hiring Program | Extended to May 7, 2022 (with possibility to extend to July 2, 2022) |

Available for eligible employers that increase wages and suffer a minimum decline in revenue. Also proposed is an increase to the subsidy rate from 20% to 50% for the October 24-November 20, 2021 claim period. |

| Tourism and Hospitality Recovery Program | October 24, 2021 – May 7, 2022 (with possibility to extend to July 2, 2022) | Wage and rent subsidies available for eligible employers in the tourism or hospitality industries with a minimum revenue decline of 40% in the period and in the prior year. |

| Hardest-hit Business Recovery Program | October 24, 2021 – May 7, 2022 (with possibility to extend to July 2, 2022) | Wage and rent subsidies available for eligible employers in any industry with a minimum revenue decline of 50% in the period and in the prior year. |

| Public health lockdown support | October 24, 2021 – May 7, 2022 (with possibility to extend to July 2, 2022) | Wage and rent subsidies available to eligible employers with a current-month revenue decline of at least 40% and have at least 25% of their revenue in the prior reference period from activities restricted due to lockdown. No prior year revenue decline is required. |

| CEBA |

Program no longer open for application. Repayment deadline of December 31, 2022 |

Freeland mentioned extending the repayment deadline for small businesses, but no specifics were provided. |

| Canada Worker Lockdown Benefit | October 24, 2021 to May 7, 2022 (with possibility to extend to July 2, 2022) | $300/week for workers unable to work due to a lockdown. |

| Canada Recovery Caregiving Benefit and Canada Recovery Sickness Benefit | Extended to May 7, 2022 (with possibility to extend to July 2, 2022) |

$500/week available under either program. CRCB max duration increased from 42 weeks to 44 weeks. CRSB max duration increased from 4 weeks to 6 weeks. |

| Home Office Expense deduction | 2022 taxation year | Simplified flat rate method available again (introduced in 2021) and max increased to $500. |

Additional tax-related announcements

Luxury Tax: A tax equal to the lesser of 10% of the value of a luxury car, boat or aircraft and 20% over the threshold ($100,000 for cars and aircraft, $250,000 for boats). Nothing new in the FES, other than a note that draft legislation will be released in early 2022.

Carbon Capture Utilization and Storage: an investment tax credit (ITC) for CCUS projects was announced in Budget 2021 for blue hydrogen projects and direct air capture projects, as well as the potential for tax support for green hydrogen producers. Again, nothing new in the FES except that the final design of the ITC will be announced in Budget 2022.

Northern Residents Deduction: The government reiterated its intention to increase access to the Northern Residents Deduction. This was mentioned in Budget 2021.

The information contained herein is intended for general informational purposes only and does not constitute as advice or opinions to be relied upon in relation to any particular circumstance. For more information about this topic, please contact your Grant Thornton advisor. If you do not have an advisor, please contact us. We are happy to help.

Get the latest insights in your inbox.

Subscribe to receive relevant and timely insights and event invitations.